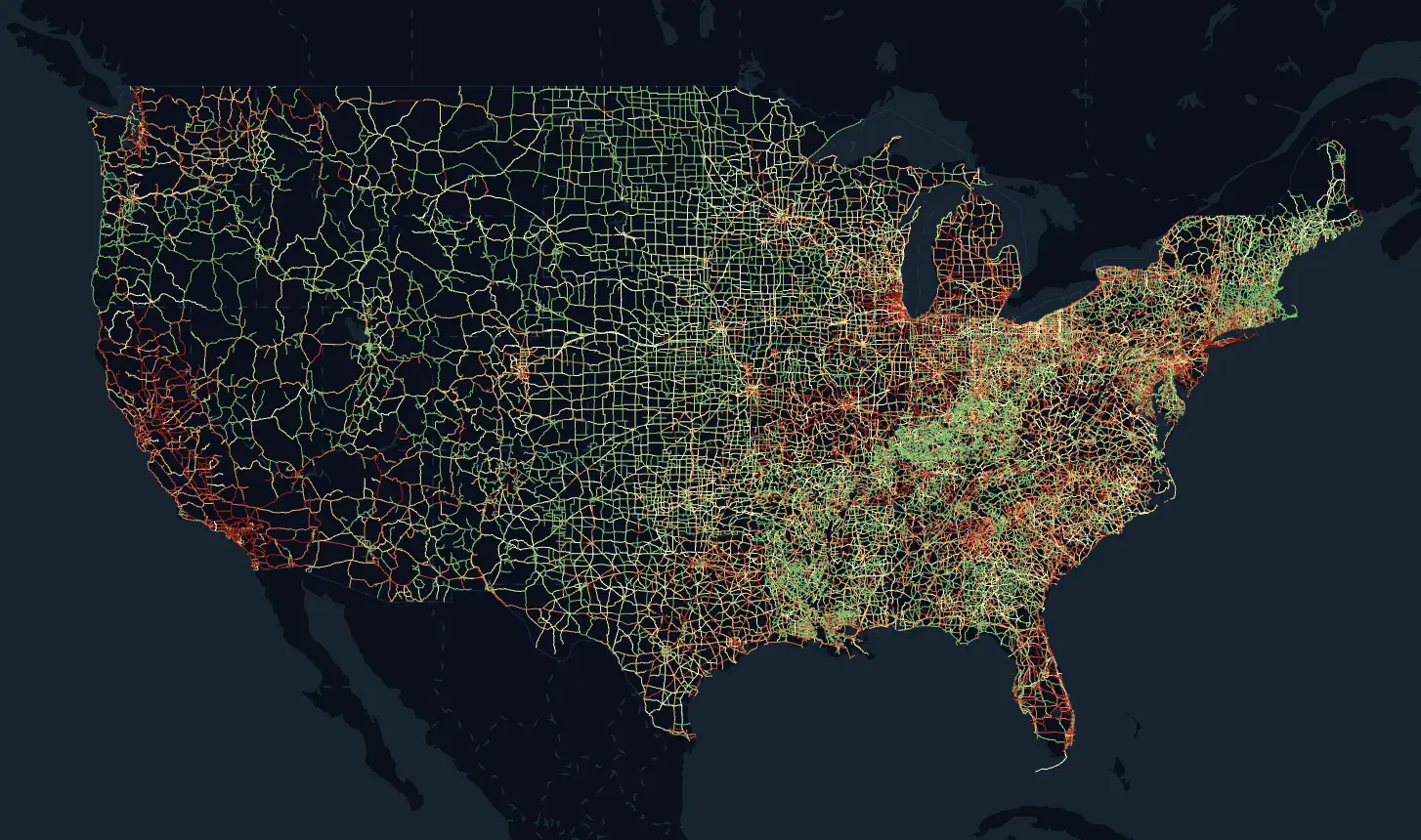

Location risk scoring for roads

Leverage the industry's richest road network data to predict auto risk, traffic volume, and underwriting performance—delivered as a simple, actionable 0–100 score.

Transform your insurance operations

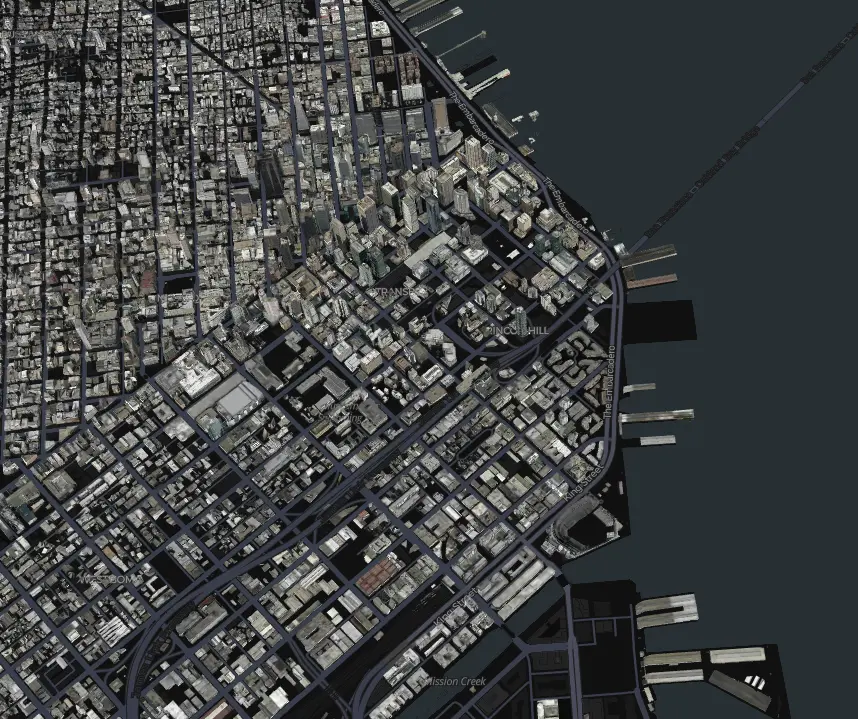

Extra, independent signal that separates look-alike addresses—credit simpler tiles, surcharge complex junction clusters.

Fill sparse areas and smooth noisy experience; better geo relativities without overfitting to a few bad years.

Scan the in-force book to surface mispriced pockets, high-leakage routes, and inspection targets.

Works on new business and new geos—no need to wait for your own loss history.

Interpretable 0–100 score tied to road layout—not demographics or personal data.

Catch emerging risk as cities add lanes, signals, roundabouts, or turn restrictions.

Improve risk selection with precision scoring

One map, one score. Flag addresses near complex junction clusters for extra review; credit simpler layouts to stay competitive.

Transform your insurance operations

Make more informed underwriting decisions with precise location-based risk assessment.

Optimize pricing strategies to capture appropriate premiums for risk exposure.

Reduce claims frequency and severity through better risk segmentation.

Decrease time to quote and bind with faster, more accurate risk assessment.

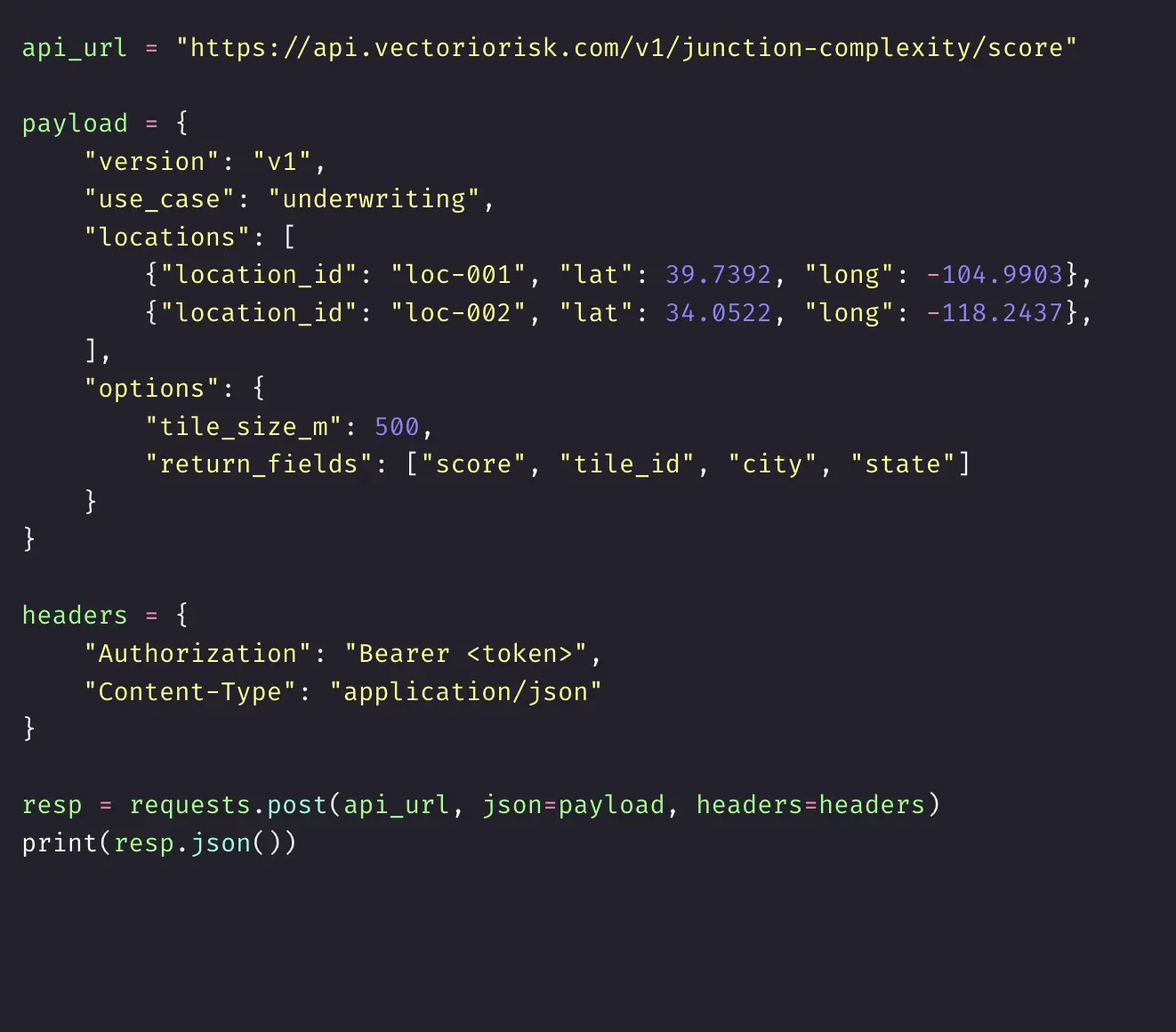

Simple API access

Drop our 0–100 road risk score into rating, underwriting, or routing. Nationwide coverage, monthly refresh.

Security & privacy

- Privacy‑first: no personal driver data.

- Least‑data product: area‑level scoring only.

- Enterprise: SSO (SAML/OIDC), DPA, and SLA available.

- SOC 2 program in progress; reports available upon request when completed.